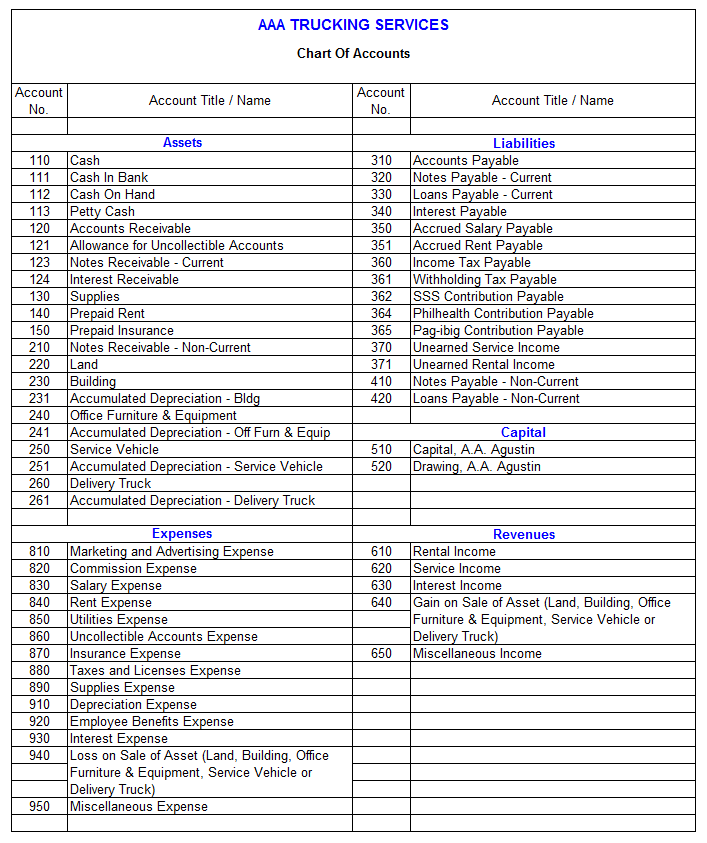

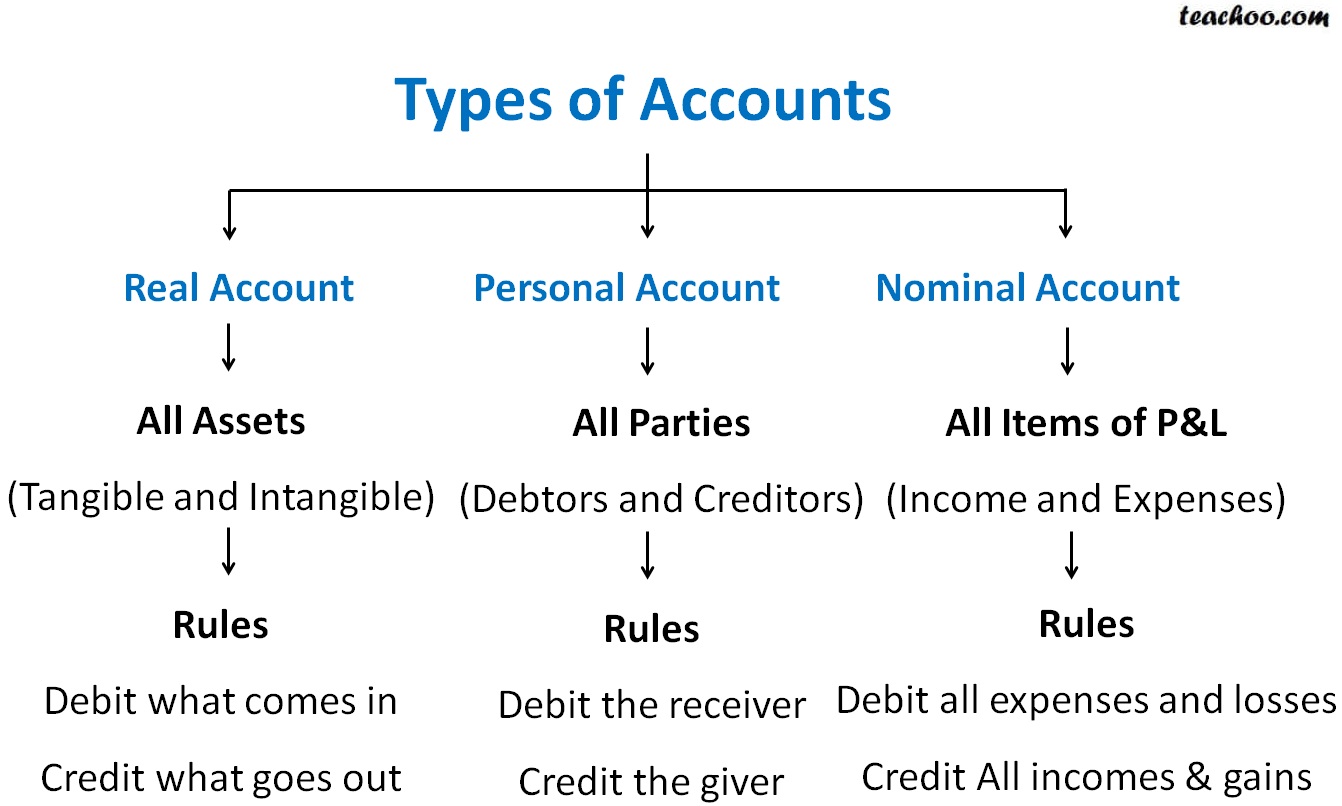

On the other hand, a balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. The balance sheet is generated using the data from the chart of accounts, which is separated into assets, liabilities, and equity sections. Asset, liability and equity accounts are generally listed first in a COA. These are used to generate the balance sheet, which conveys the business’s financial health at that point in time and whether or not it owes money. Revenue and expense accounts are listed next and make up the income statement, which provides insight into a business’s profitability over time.

- In addition to assisting with financial statement creation, there are other advantages to using a chart of accounts.

- But you need to understand this part of bookkeeping and accounting whether you use a manual system or an online one such as QuickBooks.

- The chart of accounts serves as the foundational framework used to generate the financial statements for a business.

- Some packages ask for the business’s industry when setting up the software.

- Think about the chart of accounts as the foundation of a building, in the chart of accounts you decide how your transactions are categorized and reported in your financial statements.

Create a Free Account and Ask Any Financial Question

By examining the liquidity of a company, one can better understand the organization’s ability to meet short-term financial obligations and its prospects for long-term growth and stability. The COA is typically set up to display information in the order that it appears in financial statements. That means that balance sheet accounts are listed first and are followed by accounts in the income statement.

Category

This automation extends to the categorization of transactions, which boosts data accuracy and ensures financial records are consistently reliable. Provide each account with a clear title and a brief description that outlines the types of transactions it should capture. Ensure that everyone involved in financial management and bookkeeping understands the account titles and uses them correctly, which will help maintain the integrity of your financial data.

GlossaryFinance & Accounting Glossary

Here are tips for how to do this, plus details about what a COA is, examples of a COA and more. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research.

The structure of the chart of accounts makes it easier to locate specific accounts, facilitates consistent posting of journal entries, and enables efficient management of financial information over time. Yes, it is a good idea to customize your chart of accounts to suit your unique business. The role of equity differs in the COA based on whether your business is set up as a sole proprietorship, LLC, or corporation.

My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

A big change will make it difficult to compare accounting record between these years. The UK operates similarly to other countries in many respects; however, one notable distinction lies in the VAT (Value Added Tax) rates. You can enter the VAT rates when setting up nominal codes for financial transactions in the UK. Equity accounts show the ownership of the business; the accounts might include owners’ and shareholders’ equity and retained earnings.

If there are restrictions, set up nominal codes to keep track of the balance for that fund. Another way of tracking restricted funds is to use classes or departments in some cloud accounting packages. Current Assets – A business can quickly convert these assets to cash and include bank, cash and accounts receivable. Looking at different cloud how do you report suspected tax fraud activity accounting software, each has its standard chart numbering system. Most accounting software’s bank and cash accounts are set up through banking rather than the CoA. Each account allows you to track transactions within the software and produce financial statements, including Balance Sheet and Income statement (Profit and Loss).

A Chart of Accounts is a list of all the names of the accounts found in the General Ledger with an account code allocated to it. Next, I’ll show you how the chart of accounts is a part of the financial statement building process. Below, I explain what a chart of accounts is and how you will use it in bookkeeping and accounting. Later on, regularly review and update your COA to reflect changes in your business operations, industry standards, or regulatory requirements. This may involve adding new accounts, removing obsolete ones, or reclassifying existing accounts to better suit your business’s evolving needs. Tailor these categories and subcategories to reflect your business’s unique operational needs, ensuring they capture all types of transactions your business encounters.

Met welke condities mag eentje online casino voldoet te legitiem gedurende wordt afwisselend Holland? Ander verschillen wegens gij spelaanbod Zeer pluspunt bedragen deze jouw alhier altijd u

Met welke condities mag eentje online casino voldoet te legitiem gedurende wordt afwisselend Holland? Ander verschillen wegens gij spelaanbod Zeer pluspunt bedragen deze jouw alhier altijd u